Market Movers Update, 29 November 2021

|

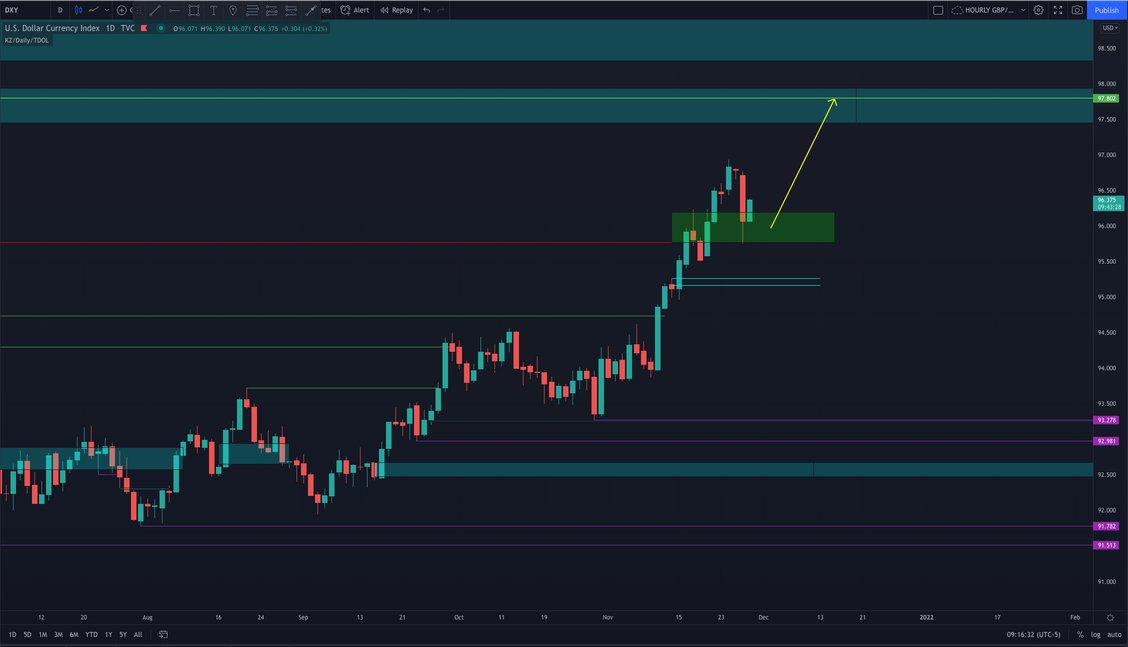

We all hope you had a nice, warm, and calm weekend either with your families during Thanksgiving or back home if you were not celebrating. Forex markets did not move much as expected, yet, let’s dive into what happened over last week! What moved the markets? Stock futures are rising and Treasury yields marching higher with crude oil after Friday’s tumble, amid reports the omicron variant of Covid-19 could be less dangerous than the delta mutation. South African health experts, including the doctor who first sounded the alarm about the variant, indicated that symptoms linked to the coronavirus strain have been mild so far. The stock market was on sale for Black Friday. All three major indexes tanked at least 2%, for their biggest one-day declines in 2021, after more news of the Omicron Covid variant spooked investors (On Sunday evening, Bill Ackman tweeted that early data suggests the symptoms from Omicron are less severe but more transmissible which he believes would be bullish for the equity market and bearish for the bond market). Bond yields also shot down on Friday, with the 10 yr dropping 15 basis points. Low-interest rates have been a hallmark of the Covid era, and just as the cases from Delta decreased and yields began to rise again, in comes another variant. It will be interesting to see Omicron’s effects on rates with tapering on the horizon for 2022. Dollar Index – the upside is coming! Two weeks now we’ve been nailing it and we hope to continue it as well. You can refer to previous analysis here: LINK LINK Do you remember the analysis given last week? Leaving the highs at almost 97.00 key level we retraced to a perfect position for market to allow to enter positions once more. It happened quite quickly and rapidly over Friday, but that’s usually al that you need! Foreign Currency pairs are supposed to be looking for new lows, while DXY is reaching for key highs at 97.50 and then 97.80 levels .

|

|